Setting up your home budget is as easy as filling in the blanks with this free budget template you can download. Moms are often the accountant, financial adviser, and Chief Financial Officer (CFO). What my husband makes (and how well I invest and manage what we already have) has to cover what we need, and then, we worry about what we want. (Or, at least, that is the goal!) I explained in an earlier post that although my husband is the money-maker, I am the money-manager. He brings in the bacon, and I save it, divvy it up, and pay the bills with it.

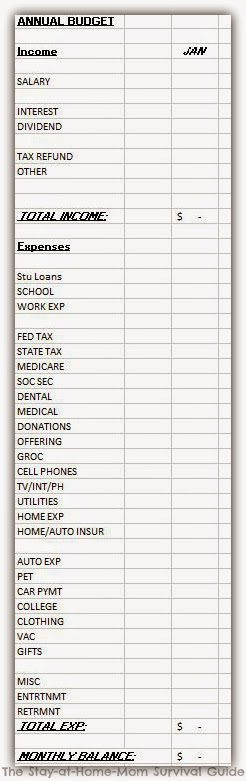

The key to balancing a household on one paycheck is knowing what comes in as far as income, and where it goes out in the avenues of your expenses. We handle this with a spreadsheet available for you to download free.

Setting Up Your Home Budget: Free Template to Download

My parents taught me how to use a spreadsheet when I was in junior high, after I had been babysitting for a few years. I really did plug in what I made and what I spent, monthly.

I did not use this method as regularly then as I do now, but it was a start to understanding that I shouldn’t spend what I don’t have, or if I did, eventually I owed more than what the original purchase was worth. Smart parents teach their children about money and saving. I am glad my parents did that for me!

Many SAHMs I know do not touch the budget: their husbands take care of it all. You and your husband have to decide if that works for you as a couple, or if it would take a little off of his plate, and add a little bit of interest to yours, for you to take on the task of watching over the family budget.

I enter our finances for each month and that gives us an idea of how we are doing financially. Everything that comes in and everything that goes out is tallied.

We wait until the end of the month (and bank statements post) before I enter in all of our income and expenses. We tally everything from our student loans to gas for the cars, groceries, and miscellaneous trips to restaurants, etc.

I pull up our bank statements to note item-by-item which amount was spent in which category. This helps us view where we are spending to help us adjust the next month. This free download budget template you can use for your home budget has formulas built in to add monthly totals and yearly totals as you go.

Again, if your husband handles this, and that works for both of you, at least try to ‘sit in’ when he goes through the budget so that you know what he is dealing with. You both should know what is where.

There are countless resources for help on how much you should be saving, spending, giving, etc. for your current and future financial goals whether it be paying off debt, buying a home, saving to send the kids to college, or retirement. I have used MSN money, Charles Schwab bank, Dave Ramsey’s website and business news networks for information.

Financial planning is on my mind every day, and I find I learn a little more as I go. You don’t have to know everything all at once, but it does help to keep reading and learning to best plan for present and future whether you have a surplus of funds or are just getting by.

If you have financial resources that you recommend please feel free to comment below so that others can share in the knowledge! I always appreciate learning of new ideas and resources.

Grab your home budget template here and get started managing your money responsibly today!

How do you manage and keep track of the finances in your household?

Follow The Stay-at-Home-Mom Survival Guide:

- Subscribe to the newsletter to receive weekly updates plus snippets of mom motivation via email.

- Join with me and other moms over on Instagram, Facebook, or Pinterest.

- Looking to connect with other Stay-at-Home Moms for support and connection with other who “get it”? Join our private Facebook group.

For teaching children about money check out: 6 Tips for Teaching Children Money Management

Looking for ways to earn money working at home? Here is a resource for you: Work at Home Job Resources for Moms

This is a great resource! I pretty much manage the finances and have used a spreadsheet but not every month.

Thanks, Melissa! It is so handy to keep track of the finances. Can't say that we are always perfectly planned, but we can catch ourselves thanks to using this spreadsheet before we get in too deep of a hole.

I am a very young (21) SAHM. I'm still trying to figure out what I want to go to school for. I really want to help more with figuring out our finances so we do not run into any problems. I've been wanting to take on this responsibility, it has also been offered to me to do so, but I'm not really sure how to go about it. I am very frugal and am very good with getting a lot for my money but I'm not exactly sure how to set a budget and figure in bills, grocery's,ect. You mentioned a spread sheet, I know what those are but I'm not exactly sure how i would do that. Any tips would be very help full because I want to help my family out so I would some what be helping financially. I don't feel very good about being just a stay at home mom some times. I want to do more.

I completely understand that you would want to help out with budgeting and the money management. I think it's a great job for SAHMs to take on. It is very easy to start a budget-you don't even need to use a spreadsheet like the one I have linked to above. First thing you have to do is make two columns on a piece of paper: "Income" and "Expenses". Every dollar of money that comes into the house in a month gets written in the "Income" column and gets labeled what it is-"salary/regular pay," "tips," "tax refund," etc. Then write down every regular expense for a month-"auto/gas," "utilities," "clothing," "groceries," etc. You can do this ahead of time to map out what bills you already have that need to be paid each month and then you will have a better idea of how much extra money you have left over. I strongly encourage that you start now saving 10% of whatever income comes into the house. It took us a few years of marriage to get to the saving point, but we do it first so we don't even count on that portion of income for our expenses. It's important to do this so you have an emergency fund. I hope that you can at least start here with what I have shared. Then check out the budget spreadsheet I have listed above if you want to have the computer do the math for you-all you have to do it enter the amounts for each category. Also check out the additional websites I have listed above to learn more about why budgeting is important. I wish you well and if you have any more questions you are free to contact me from my email listed on the "The Mission" page of this site. Take care!