This post is sponsored by Giving Assistant for Moms Affiliate. Please view my disclosure.

These 4 money-saving tips allow you to keep more money in your pocket while also giving to charities that you choose.

You do not have to spend a lot of money to give your children a good life and become financially stable. I make it my mission to be as frugal as possible just so I can teach that to my children.

My parents always taught me the “pay yourself first” first concept so we do not become a burden on someone else. Over time, that lesson teaches you to be financially stable and then allows you to help others.

That is really the goal of many of us-to get financially stable and be able to help those in need.

I really believe that my husband and I can provide our children a great life without buying them everything they want. It takes simple money-saving tips to become financially stable.

Here are 4 simple money-saving tips:

1) Create activities at home with the kids

This blog is a one-stop-shop for this idea! I only share kids activities that can be created quickly with simple and often upcycled supplies. Get creative, or look to those with creative ideas to guide you!

You don’t need to spend a fortune on craft supplies and learning activity kits to prepare your child for school or keep them engaged at home. You will feel so productive when your child learns a new skill and YOU were the one to teach him…for almost free!

2) Spend time outdoors at free events

Many towns have Summer events that are free to the public. Keep the fact that it is free in mind when you attend.

Instead of spending $25-50 (or more) per person to visit an amusement park or other paid event, you are saving that by sticking to local and free.

Getting outdoors with the kids helps the time feel extra special and adds a level of adventure and exploration.

3) Get your kids helping around the house

Household chores are valuable for teaching kids self-esteem, competence and a family mission. When we work together, we learn together and feel like a team.

When children share the work in the home, it can be accomplished quicker, and there is less for mom or dad to do on their own-that saves time and money. If you were to hire out some of the tasks (cleaning, yard work, car maintenance) you would be spending extra money that you can save with more hands doing the work.

Adding money lessons by paying your children for certain jobs helps teach them about earning, saving and responsible spending too!

4) Use Giving Assistant

Like I mentioned at the beginning, creating a stable financial situation for your family and having extra to give to others in need is a great goal. Paying it forward is easy when the giving is linked to things we already have to purchase.

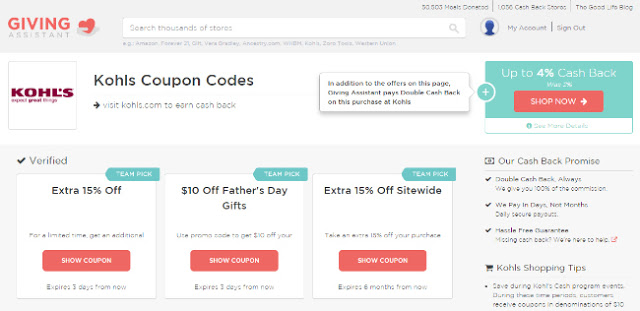

My kids grow out of clothes and shoes FAST! I know I need to budget for the expenses of making sure my kids have clothes that fit properly. Shopping through Giving Assistant retailers such as Famous Footwear or Kohl’s allows me to purchase from my favorite retailers while earning money.

When I make a purchase through Giving Assistant as a member, they earn a commission from retailers that they then pay to me! That commission (up to 5% of my purchase) gets paid back to me within days, not months, whether my balance is $1 or $25. I have the choice to receive the cash back or I can donate it to charity-an awesome incentive to give to others!

If you are not a member of Giving Assistant and make a purchase through their retailers, they pledge to donate a meal to Feed America.

If you take the cash back, that is extra money you can save or donate at the end of the year! It’s pretty awesome when programs let you earn money on purchases and donate to great causes.

I bet like me you want to save money where you can. We hear how expensive raising a child can be, but with simple tips for saving money, we can still achieve financial security and make a difference by donating to worthy causes.

Trackbacks/Pingbacks