As a teenager, I was a natural entrepreneur. I typed up a letter to offer my babysitting services to neighbors. It was my first attempt at building my own business and making money. We lived in a family-friendly neighborhood in a safe town. It was safe for me to place my typed letter into the neighbors’ mailboxes to get the word out. I was ready and willing to babysit all summer.

My parents saw my eagerness to earn money. They knew to teach me good spending habits and how to budget. Teaching financial literacy for teens is something we have to do as parents. It is a vital part of parenting our children.

One of the problems with traditional youth accounts is that the child cannot easily see their balance. We would have to give our child login access to our bank account for them to see the account.

That is not wise right now when they are so young. The solution: Modak app.

Disclaimer: This review reflects our genuine opinions and personal experiences with the Modak Debit Card. If you are interested in their product, we have partnered with Modak to offer a $10 welcome bonus if you join with the unique code CHECKMODAK, which also helps us support this blog and continue bringing you valuable content. You are welcome to read the disclosure here.

Financial Literacy for Teens

Learning how to budget, save, spend wisely, and realize the value of earning money is important for our teens. I know Home Economics classes may not be in the schools these days. But, we can teach financial literacy for teens at home!

We are doing household management, budgeting, and home tasks anyway. Our children see that when they spend time with us.

Obviously, children need to learn financial responsibility in a protected way. There are baby steps to being independent with money. Lessons are needed along the way.

But, how do we find the balance between giving our teenagers freedom while also making sure they don’t get too deep into bad habits? Let’s dive into how to teach teens good spending habits using the Modak app.

Teaching Teens Good Spending Habits

This list of steps will teach your teen how to be responsible with money. As the mom of teenagers, I have used these tools and tips in my own home with my children.

With the assistance of the Modak app, you will be able to teach your teen the excitement of earning through having them do chores. They will also learn the responsible behavior of saving with its features.

And, best of all, your kids will have access to the MoCard (Modak’s VISA debit card exclusively in their names) allowing you to send their allowance you will be able to monitor everything seamlessly.

Steps to Teach Kids and Teens Smart Money Habits

Require Chores

We have our children do chores starting at the age of 5. The Modak app makes the process easy to assign your teen chores and the amount they earn when completed.

I love that the Parent account and Teen account are linked. That way my teen can learn money habits while I set the parameters. They feel free to earn and spend, but I set the chores and guidelines.

When our children were around 12, they started asking about babysitting, pet sitting and doing yard work for neighbors. They were motivated to earn money.

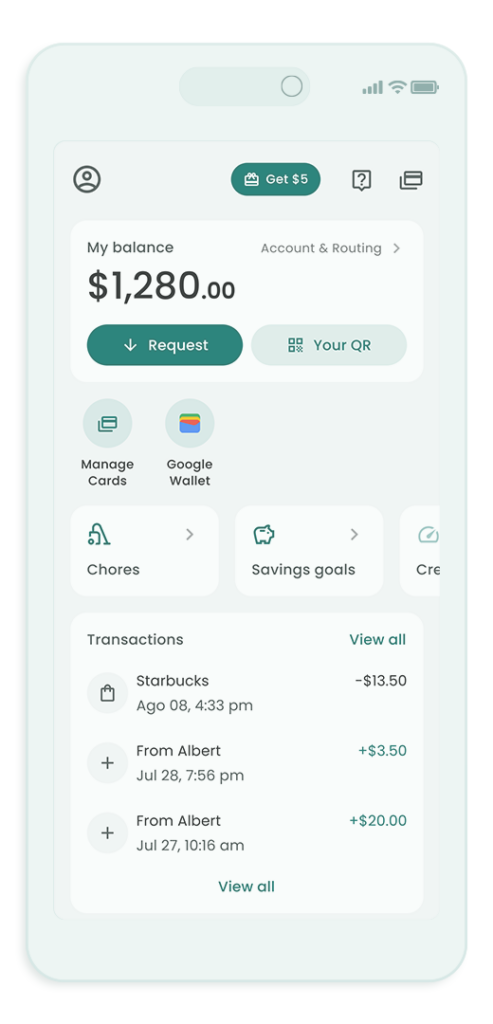

In the Modak app, teens can create a payment link. This facilitates teens to be compensated for online jobs or receive monetary gifts from relatives. It can all be monitored by you.

Teach Spending and Saving in the Modak app

Modak is a dedicated app for parents that allows them to transfer their allowance to their children. Within the app you can monitor their spending habits they have with the MoCard and track their transactions. The parent account gives you oversight.

The teen/child account gives access to earning through work and very soon, spending will be allowed or blocked, so the teen only spends where the parent allows.

The Modak app is for kids under 18 years old. Even kids who are just learning to do chores and spend their own money can use Modak and request the MoCard.

Simplify Teen Spending with the MoCard

In the past, during my teenage years, everything was done with cash. However, in today’s modern world, numerous establishments operate in a cashless or card-only basis. Carrying large amounts of cash is no longer as secure due to concerns about loss or lack of tracking for expenses.

Nowadays, having a card has become essential. It offers a safer and more transparent method for us parents to manage our children’s finances. Modak recognizes this need and provides a solution by offering a reliable and secure debit card for kids.

The MoCard (Modak’s Visa debit card) is accepted at all locations where Visa is accepted works everywhere VISA is accepted. Everything teens earn in the app by completing fun challenges, doing chores, or receiving allowance deposits from their parents can be used with

the card. You can lock and unlock the MoCard card at any time through the app.

Financial Games and Education Built-In

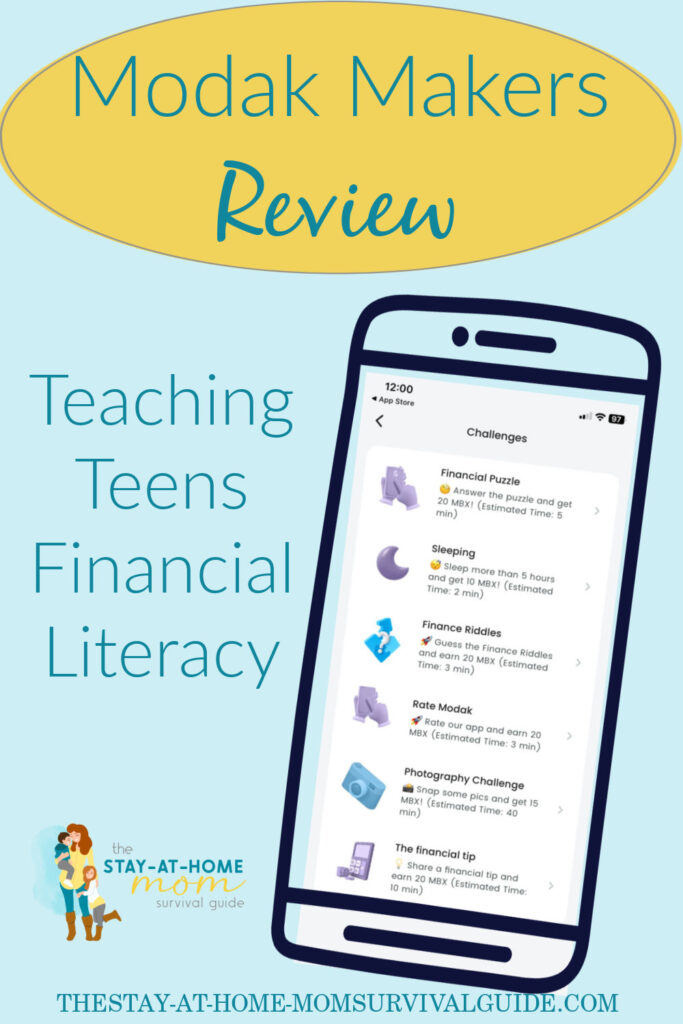

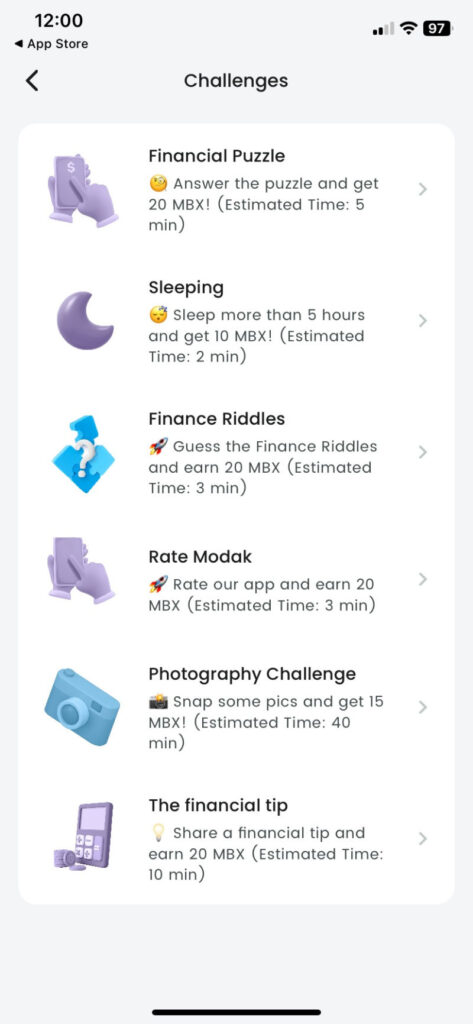

With Modak, your teen can see exactly what they can earn. They are motivated by the games and challenges to encourage healthy habits like daily steps and other incentives, through which they can earn money. There are articles that teach financial concepts. Even healthy habits are encouraged.

Kids can earn daily MBX by meeting specific criteria. These in-app reward points can then be converted into dollars and used via Modak’s Visa debit card.

Teens learn how to access their money, manage what they have and spend within that limit. These are such important life skills to each!

Modak enables teens to allocate their funds into different ‘buckets’ to achieve specific financial goals like saving, buying a car, or saving for a video game. This teaches budgeting and saving right in the app!

Security of Modak and MoCard

The money at Modak is secured through their partnership with Lewis and Clark Bank, Member FDIC. Hence, the deposits have FDIC insurance for up to $250,000! And it is easy to fund your account using Apple Pay, Google Pay, Debit card, Credit card, or direct transfer. They can reload their balance easily, with many methods available, and instantly.

With Modak, there are no monthly fees or deposits to open an account or order a card, unlike other debit cards for kids.

Use code CHECKMODAK to start using the app today. You and your teen can set up accounts using the code.

By monitoring and encouraging our teens to earn and spend wisely, we teach them valuable financial literacy. The Modak app helps us lecture less and empower our teens more.

We learn to give our teens some independence. Our teens learn valuable financial literacy lessons along the way. Get Modak today to start your teen on a path to good spending habits.